Introduction

Cryptocurrency is no longer just a passing trend; it has become a global phenomenon. With over $4.1 billion lost to DeFi hacks in 2024 alone, understanding the fundamental elements that underpin the success of cryptocurrencies has never been more critical. Among these elements, tokenomics plays a pivotal role in determining a token’s potential and longevity.

In this article, we will delve into Tokenomics Analysis—the study of the economic model of cryptocurrencies. We will explore its importance, the components involved, and the impact of tokenomics on market behavior. Additionally, this analysis will include insights specific to the Vietnamese market, where user growth is soaring, alongside strategic uses of the keyword “tiêu chuẩn an ninh blockchain” to cater to local SEO.

What is Tokenomics?

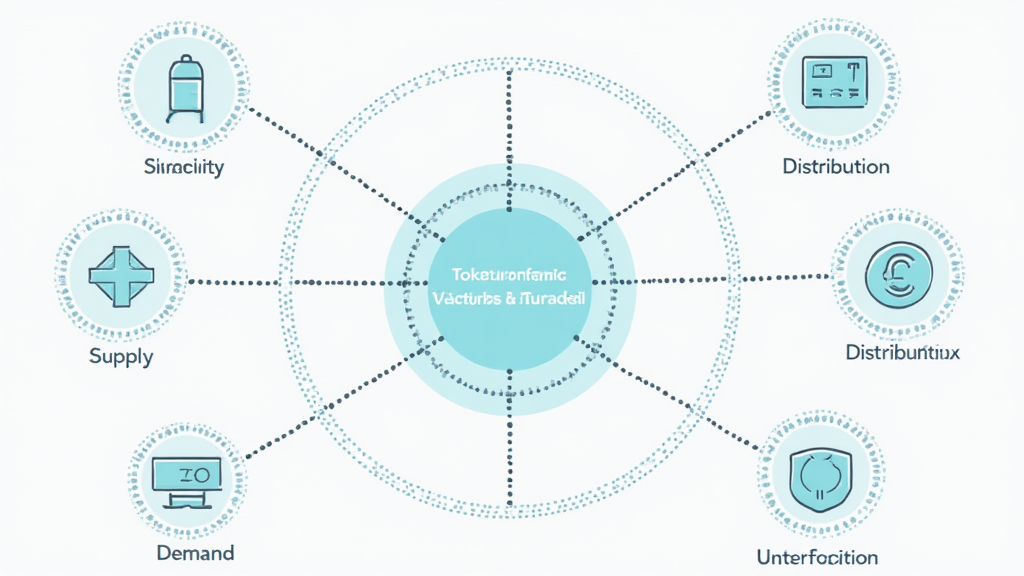

Tokenomics encompasses the economic principles and mechanisms governing a cryptocurrency or a blockchain project. It includes various factors such as supply and demand dynamics, utility, token distribution, and mechanisms for incentivizing and rewarding users.

- Supply and Demand: The total supply of tokens and how they are distributed impacts their value. Limited supply can create scarcity, driving prices up.

- Utility: The function of the token within its ecosystem directly influences its adoption and market value.

- Incentives: Reward mechanisms are vital for encouraging user participation and fostering a healthy community around a project.

Why is Tokenomics Important?

Understanding tokenomics is essential for various stakeholders within the cryptocurrency space, including investors, developers, and users. Here’s why:

- Investor Confidence: A well-structured tokenomics model can attract investors by demonstrating the potential for growth and sustainability.

- Market Positioning: Projects with strong tokenomics are better positioned to withstand market volatility and competition.

- Community Building: Incentive structures help secure an engaged user base, essential for long-term success.

Components of Tokenomics

Let’s break down the essential components that form the backbone of a cryptocurrency’s tokenomics:

1. Token Supply

Token supply refers to the total amount of tokens that will ever exist. This can be classified into three types:

- Total Supply: The maximum number of tokens that can ever be created.

- Circulating Supply: The number of tokens that are currently available in the market.

- Burn Mechanisms: Some projects implement token burn strategies to reduce supply over time, potentially increasing value.

2. Token Utility

The utility of a token defines its function within a blockchain ecosystem. A practical utility may include:

- Access to services (e.g., decentralized applications)

- Governance rights (e.g., voting on project proposals)

- Staking rewards (e.g., earning passive income by holding tokens)

3. Distribution Strategy

How tokens are distributed at launch and thereafter can significantly affect market dynamics:

- Initial Coin Offerings (ICOs): Token sales conducted to raise capital.

- Team and Advisor Allocations: Tokens assigned to the founding team and advisors often have vesting schedules to prevent immediate sell-offs.

- Community Incentives: Programs designed to distribute tokens proportionately to user engagement.

4. Economic Models

Different economic models can influence how value is perceived and exchanged:

- Deflationary Models: Designed to reduce the token supply over time to increase value.

- Inflationary Models: Introduce new tokens regularly to incentivize collaboration and usage.

Real-world Applications of Tokenomics

To understand better the implications of tokenomics, here are two real-world examples:

1. Ethereum (ETH)

Ethereum’s tokenomics model allows the use of ETH for transaction fees and other utility functions within the Ethereum ecosystem. With a shift towards a proof-of-stake mechanism, its supply dynamics are changing, inviting speculations and new market behaviors.

| Year | ETH Circulating Supply | Market Price (Approx.) |

|---|---|---|

| 2020 | 112 million | $250 |

| 2021 | 116 million | $4,000 |

| 2022 | 120 million | $3,000 |

| 2023 | 125 million* | $2,500* |

*Projected estimates. Source: CoinMarketCap

2. Binance Coin (BNB)

BNB exhibits an engaging token model as it offers utility for trading fee discounts on Binance, as well as participation in token sales through Binance Launchpad. The regular token burns add a deflationary aspect, influencing the price positively over time.

Analyzing Vietnamese Market Trends

Vietnam has emerged as a promising market for cryptocurrency growth. According to reports, Vietnam’s cryptocurrency user growth rate is expected to outpace global averages in the coming years. But what does this mean for tokenomics?

- Buyer Demographics: Younger generations looking for investment opportunities represent a significant market segment.

- Regulatory Environment: Efforts to standardize regulations such as “tiêu chuẩn an ninh blockchain” are essential for fostering a safe investment landscape.

How to Conduct Tokenomics Analysis

Conducting a thorough tokenomics analysis involves several steps:

1. Research the Project

Gather data from official resources and reputable industry reports.

2. Evaluate the Token Metrics

Asses supply, distribution, and utility metrics against similar projects in the market.

3. Monitor Market Trends

Keep track of market movements, price fluctuations, and community feedback.

4. Consult Experts

Before making financial decisions, reach out to blockchain advisors or participate in community discussions to gain diverse perspectives.

Conclusion

Tokenomics analysis is vital to understanding the health and potential of cryptocurrency projects. By recognizing the various components—such as supply, utility, and distribution strategies—investors can make more informed decisions. As the Vietnamese crypto landscape grows, understanding key terms like “tiêu chuẩn an ninh blockchain” will also help investors navigate the regulatory frameworks effectively, ensuring better protection for digital assets.

With the increasing complexity and volatility of the market, staying informed on tokenomics can prove to be the differentiating factor between successful and unsuccessful investments. Whether you are a seasoned investor or just starting, always conduct thorough research and consider engaging with community discussions.

For more insights, visit cryptolearnzone for resources dedicated to helping you understand the nuances of the cryptocurrency landscape.

Author: Dr. John Smith, a blockchain researcher with over 15 publications in decentralized finance and tokenomics, and has led multiple audits on prominent crypto projects.