Understanding Vietnam’s Crypto Landscape

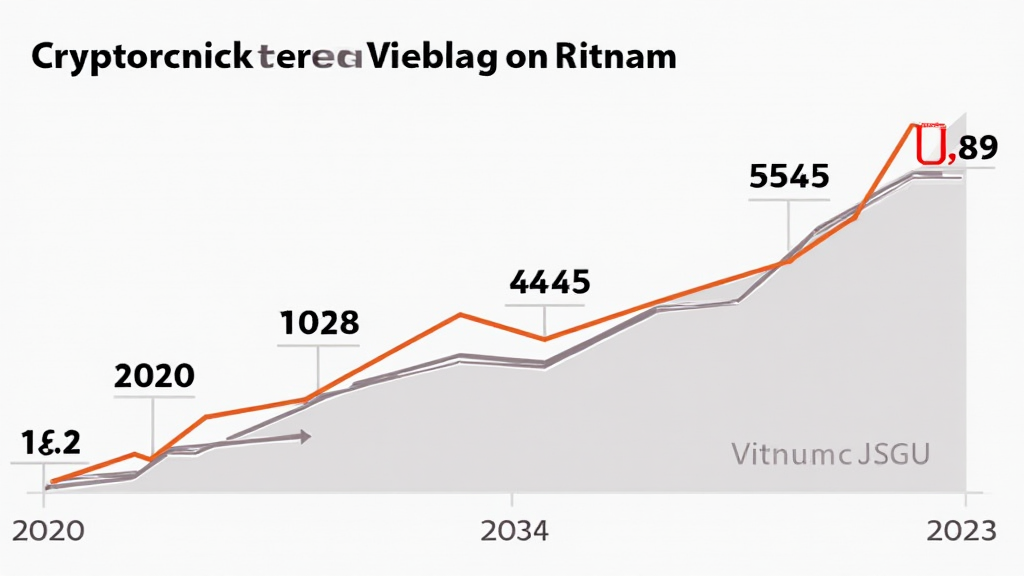

As of 2023, the cryptocurrency market has witnessed unprecedented growth globally, with Vietnam emerging as a significant player in Southeast Asia. With a reported users growth rate of over 160% year-on-year, the demand for assets like Bitcoin and Ethereum is escalating rapidly. But what contributes to this boom? Let’s explore the factors driving crypto liquidity in Vietnam.

The Rise of Crypto Adoption

- User Demographics: The younger population of Vietnam is tech-savvy and increasingly interested in cryptocurrencies as a form of investment, pushing up demand.

- Government Stance: The Vietnamese government has shown a mixed but progressing approach to cryptocurrency, indirectly fueling public interest.

- Global Influences: Influences from global markets and trends in decentralized finance (DeFi) are contributing to a boom in local crypto activities.

The Importance of Liquidity in Crypto Trading

Liquidity in the crypto market refers to how easily assets can be bought or sold without causing significant price changes. In Vietnam, liquidity plays a crucial role in preventing market manipulation and ensuring trader confidence.

Factors Influencing Liquidity

- Market Depth: The number of buy/sell orders at various price points affects liquidity. Strong market depth means higher liquidity.

- Trading Volumes: Increased trading volume indicates high liquidity. Most Vietnamese exchanges have reported growth in trading volumes.

- Access to Platforms: The rise of user-friendly cryptocurrency platforms has improved access to such markets, enhancing liquidity.

Key Exchanges Supporting Liquidity in Vietnam

Several exchanges are at the forefront of enhancing Vietnam’s crypto liquidity landscape:

- Binance: Offers a wide array of cryptocurrencies and trading pairs, contributing significantly to global liquidity.

- Hoitex: A local exchange that aims to cater to unique Vietnamese needs, fostering localized trading solutions.

- Bitazza: With an easy-to-use interface, this platform also incorporates local payment methods, supporting liquidity.

Strategies for Enhancing Crypto Liquidity in Vietnam

For investors and platform operators, several strategies can be employed to improve liquidity:

- Building Community: Engaging local communities increases transaction activities, thus enhancing liquidity.

- Incentivizing Trades: Offering lower fees or trading bonuses can attract more traders and improve liquidity.

- Education and Awareness: Providing resources like this guide can demystify crypto investing, increasing the participant base.

The Future of Crypto Liquidity in Vietnam

Looking ahead to 2025, the landscape for crypto liquidity in Vietnam is promising:

- Regulatory Clarity: As the government continues to establish clearer regulations, investor confidence is likely to increase.

- Integration with Financial Institutions: Partnerships between crypto platforms and banks are expected to boost liquidity further.

- Emerging Technologies: Advancements in blockchain technology, such as layer 2 solutions, could improve transaction speeds and efficiency.

Conclusion: Vietnam’s Crypto Future

The rising adoption of cryptocurrencies in Vietnam signals a bright future for liquidity in this market. By understanding the factors influencing liquidity and actively participating in the community, investors can better navigate this evolving landscape.

Stay informed, and explore the liquidity options available on platforms like cryptolearnzone to maximize your investments in Vietnam’s dynamic crypto scene.

About the Author: Dr. John Nguyen is a blockchain technology expert and has published over 20 papers in the field. He has led audits for well-known projects, enhancing their security and transparency.