USDC Stablecoin Regulation: Navigating the Future of Digital Currency

In the rapidly evolving world of cryptocurrencies, stablecoins like USD Coin (USDC) have emerged as pivotal players in the ecosystem. With the global stablecoin market surpassing $10 billion in circulation as of 2023, the focus on effective regulation has never been more critical. The Central Bank Digital Currency (CBDC) landscape and regulatory scrutiny over stablecoins have prompted discussions essential for the future of digital currency.

The Current State of USDC Regulation

As of 2023, regulations affecting USDC and similar stablecoins are on the rise. Governments worldwide are developing frameworks to ensure these digital assets uphold financial stability and consumer protection. Recent statistics indicate that in Vietnam alone, the adoption of cryptocurrencies has surged by nearly 30%, showcasing an urgent need for a robust regulatory environment.

What is USDC and Why is it Important?

USD Coin (USDC) is a stablecoin fully backed by true US dollars. Unlike other cryptocurrencies that exhibit high volatility, USDC maintains a 1:1 peg to the US dollar, making it a preferred choice for transactions. By acting like a bank vault for digital assets, USDC allows users to transact seamlessly and securely in the crypto space.

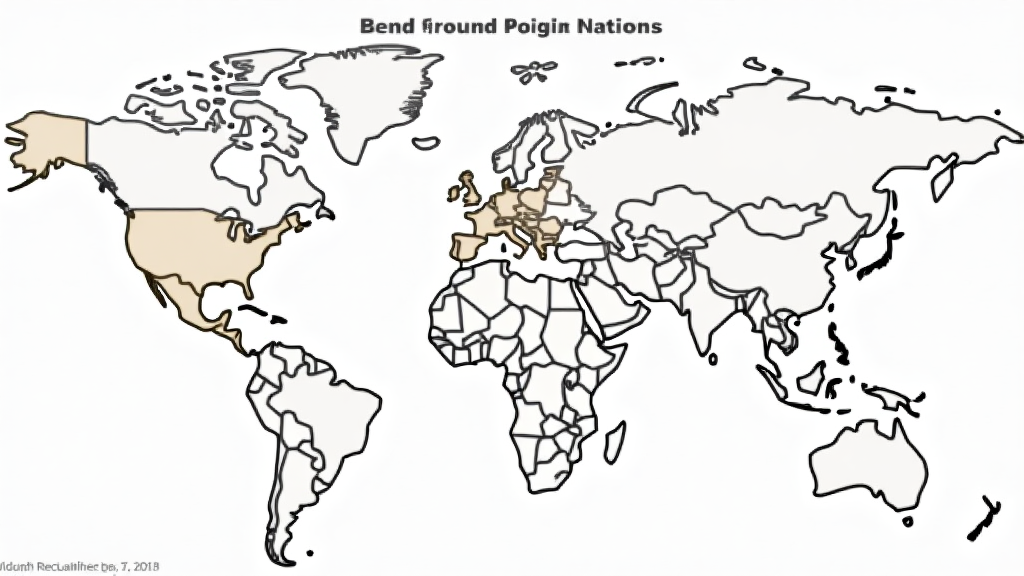

Global Regulatory Landscape

Ultimately, the key to USDC regulation lies in harmonizing policies across borders.

- United States: In the US, regulatory bodies like the SEC and CFTC are working on severe guidelines regarding stablecoin issuance and exchanges.

- European Union: The EU has introduced the MiCA (Markets in Crypto-Assets) regulation, setting out rules specifically targeting stablecoins.

- Vietnam: With regulatory pressures mounting, the Vietnamese government is considering frameworks to legitimize cryptocurrency usage among its growing digital economy.

Challenges of Stablecoin Regulation

Regulating USDC stablecoins presents several significant challenges:

- Transparency: There are concerns regarding the liquidity and reserves backing USDC. How can users trust that every token is truly backed by one US dollar?

- Cross-border Issues: Different jurisdictions have varying views on stablecoins, making international regulation complex.

- Technological Advancement: As blockchain technology continues to evolve, regulatory frameworks must adapt quickly to keep pace.

Future Implications for Users and Platforms

As stablecoin regulations evolve, both users and crypto platforms must remain agile. Adopting best practices for compliance will be crucial. Tools like smart contracts can enhance transparency, providing public proof of reserves that may bolster personal trust.

The Role of USDC in DeFi

Within the Decentralized Finance (DeFi) ecosystem, USDC serves as a fundamental building block. Users can borrow, lend, and trade using USDC in various protocols, and ensuring its regulatory compliance will be a cornerstone for sustainable growth.

Benefits of Using USDC in DeFi

- Low Volatility: USDC’s stability allows users to engage in lending and borrowing without fears of cryptocurrency price swings.

- Liquidity: USDC’s widespread adoption guarantees liquidity, enabling easy entry and exit from markets.

- Interest Earnings: DeFi platforms often provide attractive yield opportunities on USDC deposits.

Investment Insights

As of 2023, investment strategies involving USDC are increasingly popular. Investors have become more attuned to using stablecoins to hedge against the volatility of traditional cryptocurrencies.

How to Safeguard Your USDC

- Use Trusted Wallets: Ensure that you store USDC in secure wallets, preferably hardware-based.

- Stay Informed: Keep abreast of regulatory changes and industry developments to make educated decisions.

- Diverse Holdings: Don’t keep all your assets in USDC; consider diversifying into other cryptocurrencies.

Conclusion

In conclusion, the regulation of USDC stablecoins is vital for establishing a resilient framework for the broader cryptocurrency ecosystem. As USDC continues to play a significant role in today’s digital economy, proactive engagement by investors, platforms, and regulators alike will shape its future. By understanding the intricate dynamics of USDC stablecoin regulation, stakeholders can participate more effectively in the evolving market landscape. As regulations tighten, platforms must adapt and innovate to maintain user trust in this essential digital asset.

For further insights on cryptocurrency regulations, particularly relating to the evolving market in Vietnam, read our comprehensive guide.

As we navigate these complex waters, ongoing research and transparency will be critical in achieving a stable and user-friendly digital currency ecosystem.

Author: Dr. Maria Nguyen, a renowned blockchain security expert with over 20 publications in the field and lead auditor for the Vietnam DeFi Compliance Initiative.