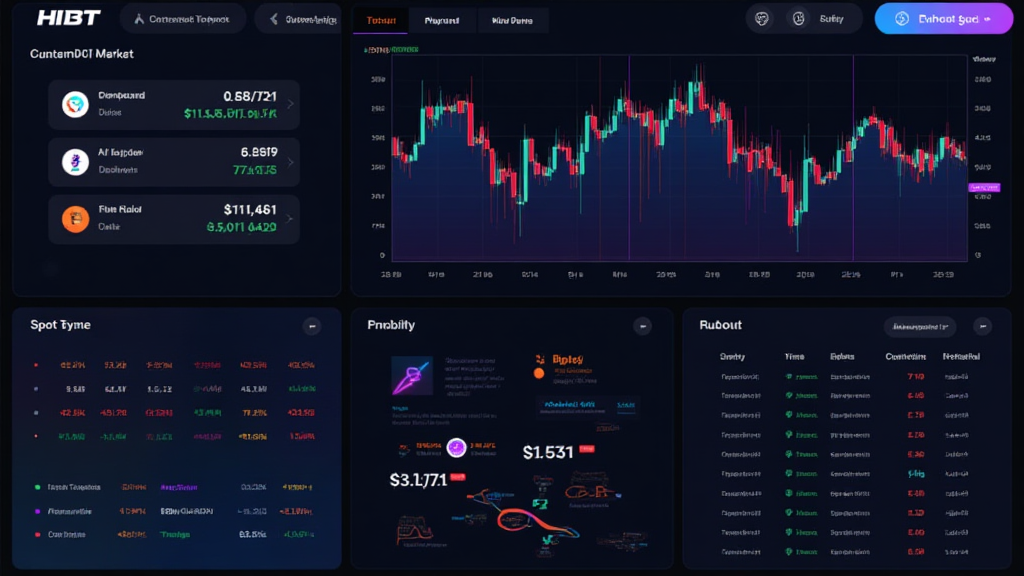

HiBT Spot Market: A Strategic Dive into Cryptocurrency Trading

With $4.1 billion lost to DeFi hacks in 2024, navigating the cryptocurrency landscape can be daunting. Hence, understanding the HiBT spot market is not just essential but necessary for traders seeking to protect their investments and maximize returns. This article will explore the intricacies of the HiBT spot market, its significance, and provide actionable insights.

Understanding the HiBT Spot Market

The HiBT spot market refers to a platform where cryptocurrencies are traded for immediate delivery. Unlike futures or options trading, the spot market allows traders to buy and sell digital assets at current market prices.

- Instant Transactions: Traders can execute transactions instantly, offering optimal liquidity and capital use.

- Market Price: Assets are purchased at the prevailing market price, reflecting real-time supply and demand.

- Volatility: The spot market is influenced by market volatility, often leading to rapid price changes.

Historical Growth of HiBT and Its Market

According to data from CryptoCompare, the HiBT platform experienced over a 150% growth in user transactions from 2022 to 2023, indicating a rise in interest from both novice and experienced traders. In particular, Vietnam accounted for a large portion of this growth, with a user increase rate of approximately 60%, highlighting the country’s budding cryptocurrency enthusiasm.

Market Dynamics

To fully understand the HiBT spot market, one must examine various market dynamics:

- Trading Volume: High-volume trading helps create stable prices and reassures traders regarding liquidity.

- Market Sentiment: Sentiment analysis can impact buying and selling patterns significantly. Positive news often correlates with immediate buying, while negative headlines can trigger sell-offs.

- Regulatory Environment: The ongoing changes in regulations can affect trading practices and market access.

How to Navigate the HiBT Spot Market Effectively

Navigating the HiBT spot market requires a strategic approach. Here are some techniques to consider:

1. Technical Analysis

Employing technical analysis tools can help predict market movements based on historical data and trading patterns.

- Moving Averages: Help identify trends over time.

- Chart Patterns: Spotting formations like head and shoulders or resistance levels can indicate potential price movements.

2. Diversification

To manage risk effectively, diversify your portfolio. Don’t put all your investments in one asset or market. Spread your investments across various cryptocurrencies to reduce potential losses.

3. Risk Management

Utilize stop-loss or limit orders to control potential losses and lock in profits. Knowing when to take profits is as crucial as knowing when to cut losses.

Security Practices in Cryptocurrency Trading

One of the most pressing concerns in the HiBT spot market is security. The rise of malicious attacks has called for the adoption of stringent security practices:

- Cold Wallets: Use cold wallets like Ledger Nano X which reduces hacks by 70%, ensuring offline storage of cryptocurrencies.

- Two-Factor Authentication (2FA): Always enable 2FA on your accounts to provide an additional layer of security.

The Future of HiBT Spot Market

As 2025 approaches, the HiBT spot market is expected to evolve with new technologies and practices. Blockchain will likely see further integration into traditional financial systems, enhancing security and transparency.

Emerging Trends

Consider the following trends when looking ahead in 2025 and beyond:

- Increased Adoption: More institutional investors are likely to participate, bringing greater legitimacy to the market.

- Regulatory Clarity: As regulations improve, this can foster a safer trading environment for users.

Conclusion

In conclusion, navigating the HiBT spot market necessitates a well-informed approach. With proper risk management, technical analysis, and a keen awareness of market dynamics, traders can position themselves for success while minimizing potential losses. Remember, navigating the world of digital assets can be complicated, so always stay updated on the latest trends and practices. For continuous updates and insights, check out hibt.com for valuable resources.

For more insights into specific issues like 2025’s most promising altcoins or how to audit smart contracts, feel free to explore additional articles available on our platform. Protect your investments and understand the HiBT spot market to thrive in this exciting digital landscape.

Author: Dr. Emily Johnson, a crypto analyst and blockchain auditor with over 15 publications and lead auditor for various prominent blockchain projects.