Breakout Trading Crypto Signals: Your Guide to Crypto Success

In the volatile realm of cryptocurrencies, many traders are searching for insights to navigate market movements effectively. With billions being lost and gained every year in the crypto sector, the demand for reliable trading signals has skyrocketed. But what exactly are breakout trading crypto signals, and how can they help you optimize your trading strategy? Let’s dive in.

Understanding Breakout Trading

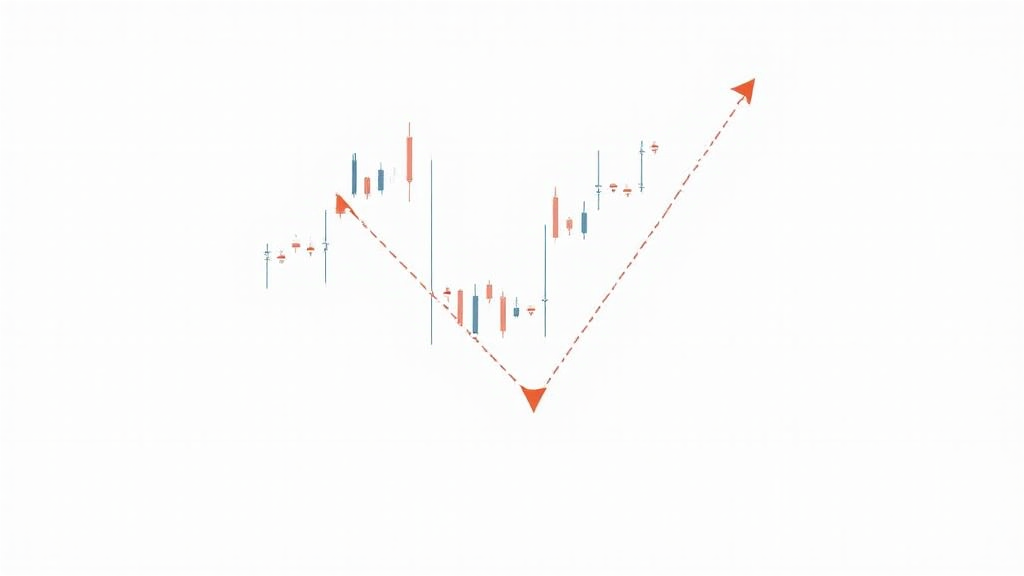

Breakout trading occurs when the price of a cryptocurrency moves beyond a defined support or resistance level. This sudden shift often leads to significant price movements. For instance, if Bitcoin breaks through a resistance level of $70,000, traders often see this as a signal to buy, anticipating further upward momentum.

In Vietnam, the crypto market has seen impressive growth, with an increase of 37% in user participation from 2022 to 2023. This growth indicates a burgeoning awareness of trading strategies such as breakout trading.

What are Breakout Trading Crypto Signals?

Breakout trading crypto signals are indicators that suggest when to enter or exit a trade based on price movements. They provide traders with insights into potential breakouts and help optimize profits. Here are a few key components:

- Technical Indicators: Tools like moving averages and the RSI can help identify breakout points.

- Market Sentiment: Analyzing news and social media can provide insights into trader psychology, affecting price movements.

- Volume Analysis: A breakout accompanied by high trading volume often confirms the validity of the move.

Evaluating Breakout Trading Signals Effectively

Like investing in real estate where the right location can increase your property’s value, identifying the suitable conditions for breakout trading can lead to substantial gains. Here are some evaluation methods:

- Chart Patterns: Look for flags, triangles, and head-and-shoulders formations as they hint at upcoming breakouts.

- Historical Data: Reviewing how a cryptocurrency reacted to similar price levels in the past can guide your predictions.

According to industry data from CryptoCompare 2025, understanding these patterns can increase your chances of success significantly.

Best Practices for Using Breakout Trading Signals

Here’s the catch: even the best signals can misfire. Hence, it’s essential to adopt best practices:

- Risk Management: Allocate only a small percentage of your portfolio to any single trade.

- Set Stop-Loss Orders: Protect profits by automating exit points in the event of unfavorable price movements.

- Stay Updated: Follow crypto news and trends to stay ahead of market sentiment and avoid making impulsive decisions.

Common Mistakes in Breakout Trading

While breakout trading can yield tremendous rewards, there are also pitfalls. Here are common mistakes to avoid:

- Ignoring Volume: A breakout without adequate volume can signal a false move.

- Overtrading: Chasing every signal can lead to significant losses. Focus on quality over quantity.

- Letting Emotions Drive Decisions: Stick to your strategy; emotional trading often results in poor outcomes.

Incorporating Vietnamese Market Trends

The crypto landscape in Vietnam is unique, presenting specific trends that traders should note. For instance, Vietnam’s interest in decentralized finance (DeFi) has resulted in a spike in DeFi-related breakout signals. Engaging with local exchanges and communities can offer insights tailored to this market.

Moreover, with an increase in regulatory clarity surrounding cryptocurrencies in Vietnam, traders can operate with a level of confidence that was previously absent.

Tools and Resources for Breakout Trading

To effectively engage in breakout trading, traders often turn to specialized tools. Here are a few recommendations:

- TradingView: Great for technical analysis with powerful charting tools.

- CoinMarketCap: A go-to for real-time market data and trends.

- Signal Providers: Services like hibt.com can offer curated breakout signals.

Conclusion

Mastering breakout trading crypto signals can be a game-changer in your crypto trading strategy. By combining technical analysis, staying updated with market sentiment, and adhering to best trading practices, you can significantly enhance your trading success.

As the 2025 crypto landscape continues to evolve, embracing strategies like breakout trading will keep you ahead of the curve. Remember to consult local regulations and consider risk management seriously.

At cryptolearnzone, we are dedicated to providing the latest updates and tools to support your trading journey.

Author: Dr. Alex Tran, a seasoned crypto analyst with over 15 published papers concerning market trends and behavioral finance. He has led multiple audits for renowned cryptocurrency projects.