Crypto Market Making: Your Essential Guide to Success

In recent years, the cryptocurrency arena has faced dramatic transformations. With over $4.1 billion lost to DeFi hacks in 2024, the importance of robust trading strategies and protective measures cannot be overstated. This article delves into the world of crypto market making, elucidating its significance, benefits, and the mechanics behind this trading strategy. As we explore, we will uncover why traders and platforms alike should consider market making as a fundamental component of their engagement in the crypto ecosystem.

The Importance of Crypto Market Making

Market making refers to the process of providing liquidity to a market by buying and selling assets at specified prices. This practice is crucial in the crypto world as it ensures that assets can be traded smoothly and efficiently without drastic price fluctuations. In Vietnam, for instance, the user growth rate in cryptocurrency trading platforms is staggering, with increases reported at over 50% annually. This rapid expansion heightens the need for effective market making strategies to maintain stability and foster confidence.

How Does Market Making Work?

- A market maker places buy and sell orders around the current price of cryptocurrency assets.

- They profit from the bid-ask spread, buying low and selling high.

- Through continuous order placement, they help to gauge market sentiment and price direction.

Like a bank vault protecting sensitive assets, effective market making shields traders from the impact of sudden price movements. There is a systematic approach to market making that includes managing risks, monitoring liquidity, and understanding trading algorithms. Let’s delve further into these nuances.

Benefits of Being a Market Maker

Market makers enjoy several advantages, including:

- Increased Profitability: By capturing the bid-ask spread, market makers can realize consistent profits.

- Market Stabilization: They help reduce volatility, making the trading environment more favorable for investors.

- Access to Enhanced Data: Being in the thick of trade also allows market makers to obtain rich insights into market trends.

According to data from Chainalysis 2025, market making has contributed to a higher liquidity ratio across the top traded cryptocurrencies, creating a healthier marketplace for enthusiasts and investors alike. However, it comes with its own set of challenges. To be effective, market makers must have a deep understanding of the trading environment and the factors influencing it.

Risks Involved in Market Making

Despite the advantages, market making is not without risks:

- Market Risk: The primary risk is that the market might move against the positions held by the market maker.

- Liquidity Risk: If a market becomes illiquid, it may be challenging for market makers to exit positions.

- Operational Risk: Technical failures or mismanagement can lead to losses.

In essence, navigating the crypto market making landscape is akin to walking a tightrope; it requires balance, precision, and vigilance.

Market Making Strategies in Cryptocurrencies

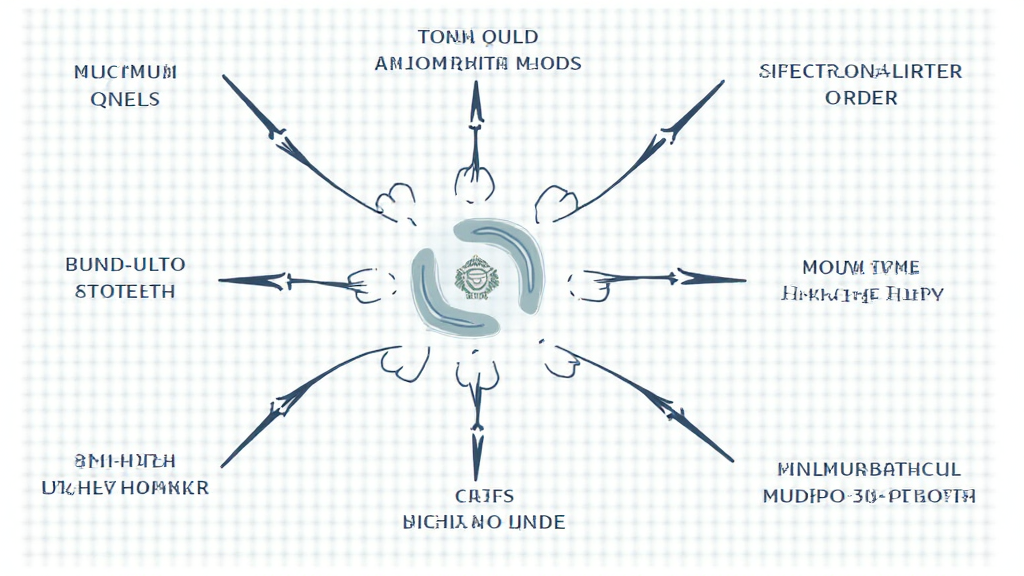

Successful market making involves implementing precise trading strategies. Here are some prevailing tactics:

- Algorithmic Trading: Automating the trading process can lead to better execution and efficiency.

- Identifying Arbitrage Opportunities: Exploiting price differences across various exchanges can yield significant profits.

- Monitoring Sentiment Indicators: Understanding market sentiment aids in predicting price movements.

By employing these strategies, market makers can position themselves favorably in the ever-evolving crypto trading landscape.

The Future of Market Making in the Crypto Space

The future of crypto market making looks promising. With advancements in technology and the continued evolution of blockchain security standards (tiêu chuẩn an ninh blockchain), new opportunities are continuously emerging. As legislation surrounding cryptocurrencies becomes clearer, the space is likely to attract even more institutional investors, which, in turn, will enhance liquidity.

Practical Tips for Aspiring Market Makers

If you’re considering stepping into the world of market making, here are some practical tips:

- Start small: Begin with a modest investment to understand market dynamics.

- Educate yourself: Studies indicate that well-informed traders perform better; immerse yourself in market analysis and trends.

- Use technology: Employ trading bots or software that can provide you real-time market data and improve execution speed.

As with any investment strategy, it’s essential to approach market making with a solid plan and sound risk management practices.

Case Study: Successful Market Makers in Action

To illustrate the principles discussed, let’s take a look at a case study of a successful market maker in the crypto domain:

- XYZ Capital: Established in 2020, with a focus on Bitcoin and Ethereum trading.

- Outcomes: Increased market liquidity on platforms by 30% through strategic positioning.

- Key Lessons: Employing advanced algorithms to monitor trades and a focus on diversity in asset selection have been instrumental in achieving consistent profits.

This case emphasizes the importance of employing diverse strategies while staying adaptable to market changes.

Conclusion: The Role of Crypto Market Making in Future Trading

As the cryptocurrency industry continues to innovate, the role of market makers becomes increasingly vital. They serve not just as liquidity providers but as vital players in ensuring market integrity and stability. In Vietnam, the rise in user adoption represents an exciting opportunity for market makers to capitalize on the growing interest in crypto trading.

By understanding the mechanisms behind crypto market making, applying the right strategies, and mitigating risks, both new and seasoned traders can harness its potential to thrive in the cryptocurrency ecosystem. Explore more insights and educational resources at cryptolearnzone.

Author: Dr. Nguyen Tran, a blockchain technology expert who has published over 25 papers in the field and led several audits of renowned projects. His extensive experience offers valuable insights into market dynamics and strategies.