Understanding Crypto Market Manipulation: Safeguarding Your Investments

With over $4.1 billion lost to cryptocurrency scams and hacks in 2024 alone, understanding crypto market manipulation is crucial for every investor. The crypto market has exploded over the past few years, attracting both genuine traders and malicious actors aiming to exploit the financial landscape for their benefit. This article delves into the complexities of market manipulation, providing insights on detection, prevention, and the legal frameworks surrounding such practices.

What is Crypto Market Manipulation?

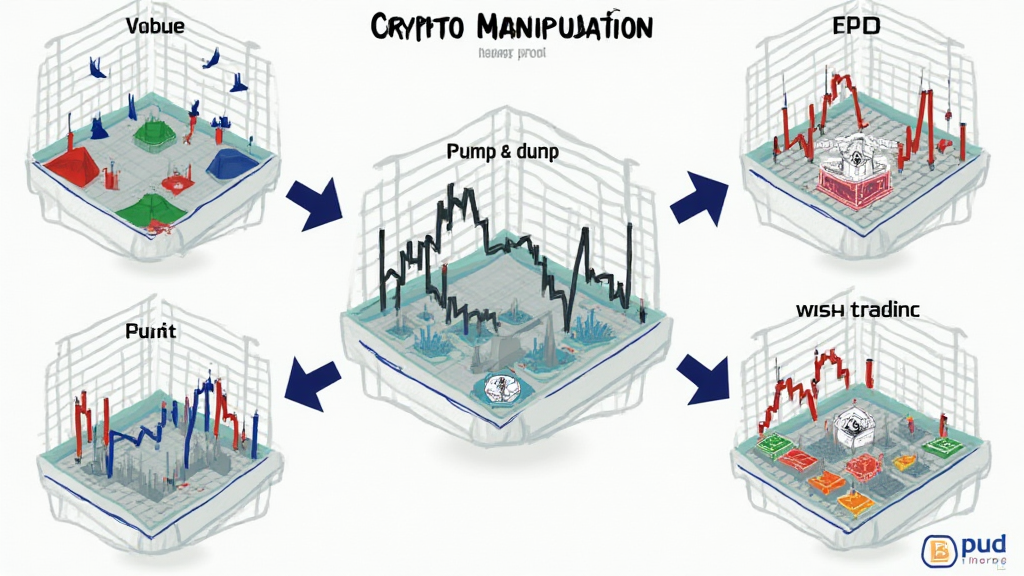

At its core, crypto market manipulation involves artificially inflating or deflating the price of a cryptocurrency through deceptive practices, thereby misleading investors. It can manifest in several ways:

- Pump and Dump: A group promotes a low-value cryptocurrency to inflate its price and sell off at a profit, leaving new investors with worthless coins.

- Wash Trading: Traders simultaneously buy and sell the same asset to create artificial volume, misleading others into thinking there is genuine interest.

- FUD (Fear, Uncertainty, and Doubt): Spreading false information to create panic among investors, leading to a sell-off.

Despite regulatory efforts, crypto market manipulation continues to thrive, highlighting the need for transparency and investor awareness.

Why Does Market Manipulation Occur?

Understanding the motivations behind crypto market manipulation reveals the underlying psychology at play:

- High Volatility: Cryptocurrencies are notoriously volatile, making them attractive targets for manipulators looking to profit from rapid price swings.

- Lack of Regulation: The decentralized nature of cryptocurrencies often means there are fewer regulations compared to traditional financial markets.

- Psychological Factors: Traders may fall prey to fear or greed, making them susceptible to manipulation tactics.

As we’ve seen, the manipulation of cryptocurrency prices can distort the market, making informed investment decisions more challenging.

How to Detect Crypto Market Manipulation

Identifying crypto market manipulation patterns requires vigilance and a keen understanding of market dynamics:

- Monitor Trading Volume: Sudden spikes in trading volume can indicate manipulation. Pay attention to volume trends and price changes.

- Watch for Unusual Price Movements: Extreme price increases or decreases without clear news events may signal potential manipulation.

- Follow Social Media and News: Keep an eye on online chatter and news stories, as these can often precede manipulative moves.

Tools like AI-powered market analysis platforms can assist in detecting suspicious behavior quickly.

Protecting Yourself from Market Manipulation

It’s essential for investors to develop strategies to protect themselves from falling victim to manipulation:

- Diversify Investments: Spread investments across multiple assets to curb risks from manipulative practices affecting any single coin.

- Do Your Own Research (DYOR): Always investigate before investing. Understand the fundamentals of the projects you consider.

- Use Reputable Exchanges: Opt for exchanges known for their security measures and commitment to transparency.

- Educate Yourself: Understanding how market manipulation works can equip you with the knowledge needed to make informed decisions.

As an investor, being proactive and staying aware can significantly decrease your susceptibility to crypto market manipulation.

Global and Local Market Statistics

To put crypto market manipulation into perspective, let’s look at some statistics:

| Year | Global Crypto Market Volume | Vietnam User Growth Rate |

|---|---|---|

| 2023 | $3 trillion | 30% |

| 2024 | $4 trillion | 35% |

| 2025 | $5 trillion | 40% |

According to recent data, Vietnam’s crypto user growth is set to rise by 40% by 2025, indicating a rapid increase in market interest but also a rise in potential manipulation opportunities.

Legal Implications and Future Outlook

The legal landscape around crypto market manipulation remains murky as authorities adapt to the ever-evolving cryptocurrency space:

- Regulatory Frameworks: Countries are beginning to implement stricter regulations to combat manipulation.

- Increased Surveillance: Technologies like blockchain analytics tools are enhancing the ability to track illegal activities.

- Future Predictions: The crypto market will likely see more significant regulatory reforms as investor protection becomes a priority.

Understanding the ongoing and future regulatory developments can prepare investors for the shifts in the crypto landscape.

Conclusion

As the crypto market grows, so does the risk of manipulation. Awareness and education about crypto market manipulation are vital for safeguarding your investments. By utilizing proper strategies, and remaining informed, you can navigate the ever-changing market landscape safely. As always, consult local regulations and do your research to ensure compliance.

For more in-depth resources and insights into crypto trading and investment strategies, visit cryptolearnzone.

About the Author:

Dr. Alex Thompson is a renowned blockchain expert with over 15 years of experience in market analysis. He has authored numerous papers on financial technologies and has led several audits for well-known crypto projects.